- 12 November 2024

- Return

We are happy to share in these pages key data and figures about the current and upcoming French campaigns. Have a look at this report to prepare your purchasing requirements of essential oils, hydrosols, dried herbs and do not hesitate to contact us for any inquiry.

Editorial

"The 2024 production campaigns are now completed.

This is an opportunity to share with you an initial assessment of the agricultural side and the market situations in which we operate.

The key factors are related to climate conditions which, in all regions of the world, are increasingly and more frequently affecting the production of aromatic plants.

Climate change is a daily reality for our producers and for us. We are working to adapt and to shield our clients as much as possible from its impacts.

The aromatic plant bubble burst 2 to 3 years ago. Market conditions had made these crops the most attractive at the time. A decline in consumption during the post-COVID period accelerated this collapse. Overproduction in many sectors and in many parts of the world (especially for essential oils) is pushing producers to leave these sectors for other, now more lucrative, activities. The next upward cycle is in preparation.

Elixens, staying true to its long-term partnership approach, encourages its clients to anticipate these upcoming market events, which, like climate conditions, are becoming increasingly intense.

We hope you find useful insights for your sourcing strategies in this fall-winter market report. The Elixens teams (in France, the United States, and the United Kingdom) are here to discuss this with you.

Enjoy your reading of our purchasing campaigns!"

Jean-Pascal ABDELLI, director of Elixens France

General background on aromatic plants

Weather analysis

The weather is one of our main concerns because it has a direct impact on the harvests.

We give you our feedback from the last few months and we share insights on future forecasts within our production area (South-Eastern France).

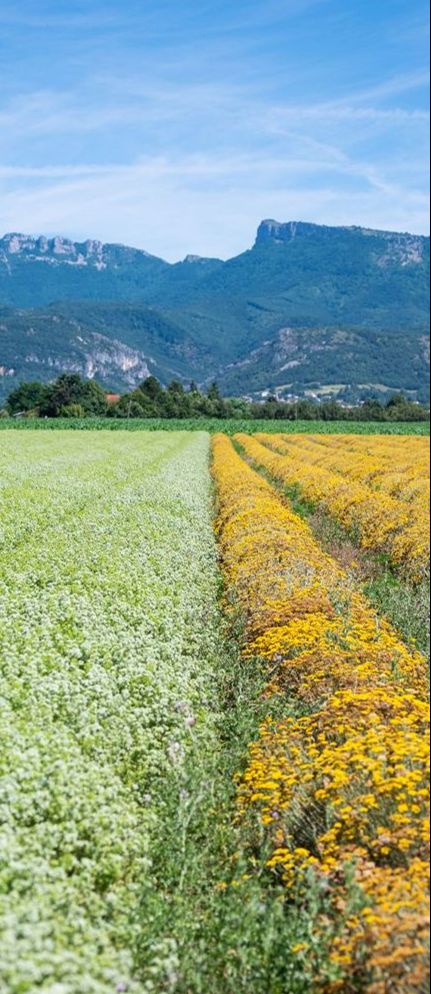

Dauphiné – Provence : a difficult summer for producers and distillers

The distillation season for fresh plants concluded in early October with the final harvests of Geranium and Peppermint. Summer 2024 proved especially challenging, with frequent rain episodes complicating the coordination of harvests and distillation. Additionally, average temperatures were 1°C to 3°C below the seasonal norms (from June to September), resulting in a lower concentration of essential oils in our crops. The support of a network of experienced local distilleries has proven to be a significant asset for our sector. In this context of reduced essential oil yields, it is crucial to also enhance the value of hydrosols and floral waters, which we carefully collect during distillation. Beyond the economic importance for producers, the valorization of these co-products is strategically essential for analyzing the life cycle of an essential oil. For instance, purchasing organic lavender hydrosol helps support lavender and lavandin producers during this period of overproduction.

Distillations conducted before July 15 yielded disappointing essential oil outputs. However, certain plants, such as helichrysum and Roman chamomile, offered very satisfactory yields.

On the herbal front, the first spring and summer harvests were abundant and well-dried, despite weather challenges. Certain plots, like fennel and marjoram, even required no irrigation due to their location. Nonetheless, cooler temperatures slowed plant regrowth, meaning some plots, such as that some plots of mint and verbena were not harvested this autumn.

This autumn, the conifer distillation campaign will begin, starting with cedar distillation in early November.

Additionally, Elixens and SICA-Bioplantes are collaborating with clients to develop new species. These promising experiments for 2024 will continue into 2025.

Finally, 2024 marks the start of a soil health analysis project with our partner producers. Samples were taken in spring and early summer. This winter will be an opportunity to synthesize results and assess the impact of our Dauphiné-Provence sector on cultivated soils.

Lavender and Lavandin Market

The evolution of the lavender and lavandin sector confirmed

In our recent reports, we highlighted the accumulation of significant stock levels and anticipated reactions within the production structure. The 2023-2024 season saw minimal reductions in production acreage. Many producers delayed major decisions, holding out hope for a market recovery.

However, autumn 2024 presents a very different picture:

The 2024 harvests were lackluster, with regular rainfall during spring and summer reducing essential oil content in the plants. Weak demand in the first half of 2024, combined with very low spot market prices, drove some producers to offload their stock at any cost—even their 2024 harvests. Fallow fields were not uncommon this summer, giving an unusual and less appealing appearance to the lavender and lavandin fields.

Pulling up plants appears to have been widespread and is expected to intensify this fall. Updated acreage data is not yet available, but it seems that while some replanting occurred last year, orders for new plants from nurseries have dried up. Numerous transactions have taken place between financially-strained producers and other industry players, resulting in significant stock volumes being stored.

The seeds of the next lavandin crisis have been planted, although how long they will take to germinate remains uncertain. Several parameters will dictate the timing of the next speculative cycle:

- Consumption levels: Demand has improved in recent months but remains below the highs of three years ago.

- Total stock levels: This season's consumption is expected to exceed effective production, marking a shift as total stock begins to decline for the first time in years. This distinction between actual production and reported production is crucial, as the latter may still include carryover from previous years.

- Available stock levels: Stock movement has occurred recently, with a significant and growing portion transferring from producers’ cellars to various sector warehouses. These stocks are likely to accelerate market reversal when tensions emerge.

- Production capacity: Cultivation acreage is expected to decline more sharply than previously anticipated. Producers leaving the lavender sector or seeking diversification will be difficult to recruit back. Restarting plant production will also require time, meaning a period of latency before production capacity rebounds.

Everything indicates that once available stock is depleted, the market will experience prolonged tension, potentially driving a sharp increase in prices.

The timeline for these changes remains uncertain. However, ELIXENS France has long promoted an alternative sourcing approach for lavender products. Medium-term volume contracts and a structured pricing methodology are proposed by Elixens France to clients committed to fair and balanced purchasing agreements and determined to avoid the next lavandin crisis.

Orange and Patchouli

Orange Market

The orange market has been under significant strain for several years, primarily due to the greening disease, which is killing the trees, and the low aldehyde content in the oil. Extreme temperature variations hinder aldehyde production, complicating the market and keeping prices high. At the same time, the market for orange terpenes is also under pressure, with supply falling short of demand. We recommend reaching out to your sales representative to secure your volumes and prices as soon as possible.

Patchouli Market

The patchouli market is currently at an all-time high. Since the beginning of the second half of 2023, patchouli prices have been rising, driven mainly by very dry conditions and the wilt disease. Prices have risen by over 50% since then.

The return of rains in Sulawesi is a positive first sign. The harvest in Sulawesi is expected to peak in June, with a slight easing afterward. No immediate improvement is expected, but conditions may improve after the summer.

Elixens France

A few weeks ago, Elixens France published its 2023 CSR (Corporate Social Responsibility) report, which highlights the company's progress in environmental and societal matters with its clients, suppliers, and employees.

In a challenging economic context, Elixens has made significant efforts to produce a positive environmental and societal balance.

You can learn more about the most significant actions and results by reading our 2023 Ethical and CSR Report.

Elixens France Achieves a B Rating with CDP in 2023, Improving from 2022 (B-)

In 2023, Elixens France received a B rating from the CDP, showing improvement from the previous year's B- score. This reflects the company's ongoing commitment to environmental sustainability and transparency.

Additionally, in 2023, Elixens and SICA BIOPLANTES established a mutualist compensation system for producers. This fund, equally contributed to by producers, SICA BIOPLANTES, and Elixens France, was created by a unanimous decision of the SICA BIOPLANTES supervisory board.

The goal of the fund is to provide partial or full compensation to producers who are unable to market their crops due to circumstances beyond their control, unrelated to the quality of their agronomic work. The supervisory board reviews the cases submitted and decides on the allocation of the fund based on needs.

The first beneficiaries of this system were affected by unresolved cross-contamination issues.

Quality Report

Elixens France continues to uphold its commitment to quality and sustainability by renewing its ISO 22000, COSMOS, and Fiable certifications, demonstrating its dedication to maintaining high standards across its operations.

Additionally, the renewal of the BIOPARTENAIRE certification reflects our strong commitment to practices that respect both producers and the environment, while ensuring the highest level of service and product quality for our clients.

We are also pleased to announce the renewal of the IFS certification for our sister company, Herbissima. This certification confirms Herbissima’s dedication to maintaining high quality and food safety standards, in line with international requirements.

Do not hesitate to browse through our catalog, to contact us for any information, or to start a project.